rtgs form hdfc pdf/neft form hdfc pdf download – Real-Time Gross Settlement (RTGS) is a fast and secure electronic funds transfer system widely used in India for large-value transactions. HDFC Bank, one of India’s leading private sector banks, offers RTGS services to its customers. To make an RTGS transaction through HDFC Bank, you’ll need to fill out an RTGS form accurately. In this article, we will provide you with a step-by-step guide on how to fill out the HDFC RTGS form correctly.

And along with this, if you need RTGS form HDFC PF, then we will also provide you RTGS form HDFC PDF download link in this article, so friends, you can read this article from beginning to end

| Scroll down to download RTGS form HDFC / NEFT form HDFC PDF. At last you will get its download link, by clicking on which you can download the form. |

Step 1: Obtain an RTGS Form

You can get an HDFC RTGS form from any HDFC Bank branch or download it from the bank’s official website. Ensure that you are using the most up-to-date version of the form to avoid any discrepancies,Apart from this, as we have mentioned in the beginning itself, you can click on the link given below to download the RTGS form HDFC, the link is given in the last, click on it and download.

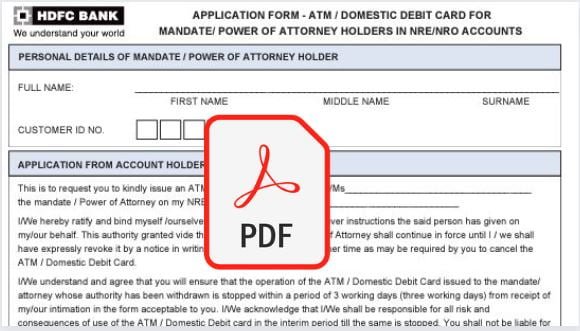

Step 2: Fill in the Beneficiary Details

Date:- Start by entering the current date in the provided space at the top of the form.

Remitter’s Details:- Fill in your name, contact number, and your HDFC Bank account number. This information is essential for tracking the transaction’s source.

Beneficiary Details:- Enter the beneficiary’s name, account number, and their bank’s name and branch. Double-check these details for accuracy to prevent any misdirected transfers.

Step 3: Transaction Details

Transaction Type:- Indicate whether it’s an RTGS or NEFT (National Electronic Funds Transfer) transaction. For RTGS, mark the “RTGS” box.

Amount:- Specify the amount you wish to transfer in both figures and words. Ensure that the amount matches the amount you intend to transfer.

Charges:- Tick the appropriate box to indicate who will bear the RTGS charges – either the remitter or the beneficiary. HDFC Bank usually charges the remitter.

Purpose of Remittance:- State the reason for the transaction. This could be for various purposes such as salary, rent, payment, etc.

Step 4: Authorizing the Transaction

Authorizer’s Signature:- Sign the form in the designated space to authorize the transaction. Ensure your signature matches the one the bank has on record.

Step 5: Verification

Verification by the Bank:- Once you have filled in all the required information, submit the form to the bank’s authorized personnel. They will verify the details and confirm the transaction.

Acknowledgment Slip:- The bank will provide you with an acknowledgment slip, which serves as proof that you have initiated the RTGS transaction. Keep this slip safe for future reference.

Important Points to Remember

Friends, the process of RTGS application form which includes beneficiary details, transaction details and after verification, there are some important things to remember which are very important for you to remember, which we have mentioned below.

RTGS transactions are typically processed on the same day if initiated within the bank’s working hours, making it ideal for time-sensitive payments.

Ensure that your account has sufficient funds to cover the transaction amount, including any applicable charges.

Double-check all beneficiary details to avoid any errors that could lead to a failed transaction or delays.

RTGS transactions are subject to a minimum and maximum limit set by the RBI, so verify the current limits with your bank.

Conclusion

Filling out the HDFC RTGS form correctly is crucial to ensuring that your high-value transactions are processed smoothly and securely. By following the step-by-step guide outlined in this article, you can confidently initiate RTGS transactions and experience the convenience of real-time fund transfers through HDFC Bank. Remember to keep the acknowledgment slip as proof of your transaction for your records

We hope that this article would have made you aware of the complete information related to RTGS form HDFC Bank, in which basically the details of NEFT form HDFC pdf / rtgs form IDFC are mentioned, despite this, you can ask questions related to these through the comment box. can ask

We will try to answer your questions quickly

Thank you very much for giving your valuable time to this article, stay with us like this, we will keep bringing you information as per your expectation.

neft/rtgs form hdfc pdf download

| form | rtgs form hdfc neft form hdfc |

| type | |

| pdf size | 408.36 KB |

| pdf page | 1 |

| credit | hdfc bank |

| official website | https://www.hdfcbank.com/ |

![[pdf] download account transfer form hdfc bank download account transfer form hdfc bank](https://pdfformdownload.co.in/wp-content/uploads/2023/09/download-account-transfer-form-hdfc-bank-f.jpg)

![[pdf] aadhaar consent form hdfc download [pdf] aadhaar consent form hdfc download](https://pdfformdownload.co.in/wp-content/uploads/2023/09/aadhaar-consent-form-hdfc-download-b.jpg)

![[pdf] account closure form hdfc bank download [pdf] account closure form hdfc bank download](https://pdfformdownload.co.in/wp-content/uploads/2023/09/pdf-account-closure-form-hdfc-bank-download.jpg)

![[pdf] download fd form hdfc bank [pdf] download fd form hdfc bank](https://pdfformdownload.co.in/wp-content/uploads/2023/09/pdf-download-fd-form-hdfc-bank.jpg)

![[PDF] dd form hdfc bank download [PDF] dd form hdfc bank download](https://pdfformdownload.co.in/wp-content/uploads/2023/11/dd-form-hdfc-bank-download-v.jpg)

3 thoughts on “neft/rtgs form hdfc pdf download”