download Advanced Form gpf/cpf – Saving for the future is a cornerstone of financial stability, and when it comes to public sector employees in India, the General Provident Fund (GPF) and the Contributory Provident Fund (CPF) have long been integral tools for securing one’s financial future. These funds provide a secure and structured way for employees to save a portion of their earnings, which then accrues interest over time. In recent years, an advanced form of these funds has gained attention for its enhanced benefits, offering employees more control and flexibility over their savings.

The Advanced Form General Provident Fund/Contributory Provident Fund (AFGPF/ACPF) builds upon the foundation of the traditional GPF and CPF systems. It brings a range of advantages that cater to the evolving financial needs of modern employees.

One of the standout features of the advanced form is increased flexibility. Unlike the conventional GPF/CPF, the advanced form allows contributors to withdraw from their accumulated funds for specific purposes such as education, housing, medical emergencies, and even marriage expenses. This flexibility caters to the changing priorities and life events that individuals experience over the course of their careers. The option to access funds in times of need reduces financial stress and promotes a sense of security.

Additionally, the AFGPF/ACPF offers a diversified range of investment options. While the traditional funds generally offer fixed interest rates, the advanced form allows employees to choose from a variety of investment avenues, including mutual funds, government securities, and equities. This presents the potential for higher returns and better capital growth, albeit with associated risks. This option is particularly appealing to employees with a higher risk tolerance and a desire to explore investment opportunities beyond the conventional savings routes.

Another noteworthy aspect of the advanced form is its digital integration. In an era of digitalization, managing financial matters online has become a necessity. The AFGPF/ACPF brings convenience by allowing employees to track their fund balances, investment performance, and contribution history through user-friendly online platforms. This not only streamlines administrative processes but also empowers individuals to have a clearer understanding of their financial status and progress toward their savings goals.

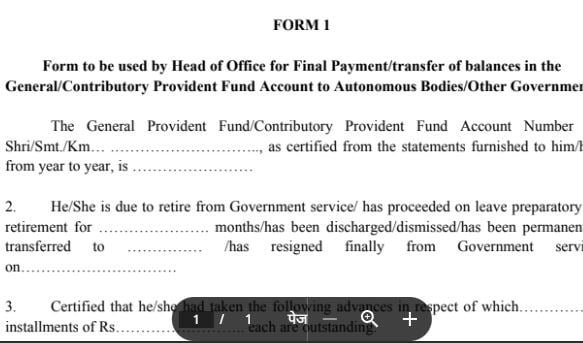

[pdf] gpf form final payment of balance in the Provident Fund Account on death

download gpf application form 1 pdf

However, with its advantages, the AFGPF/ACPF does come with certain considerations. The investment options, while offering potential for higher returns, also carry a degree of risk. Individuals must be well-informed about these investment avenues and their associated risks before making decisions. Additionally, the advanced form’s flexibility might inadvertently lead to impulsive withdrawals, potentially impacting long-term savings goals. Therefore, prudent financial planning and discipline remain crucial.

In conclusion, the Advanced Form General Provident Fund/Contributory Provident Fund brings a breath of fresh air to traditional savings schemes for public sector employees in India. Its flexibility, diverse investment options, and digital integration empower individuals to take greater control of their financial futures. However, as with any financial decision, careful consideration, proper understanding of investment choices, and a long-term perspective are essential. By embracing the benefits of this advanced form while managing its potential pitfalls, employees can pave the way for a more financially secure tomorrow

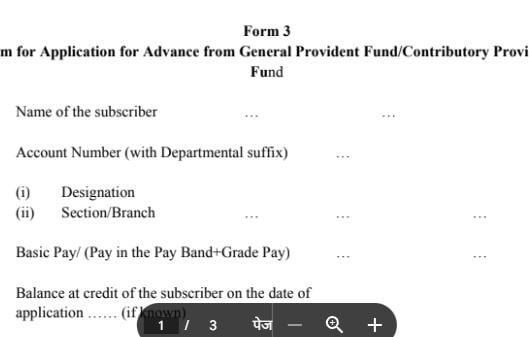

download Advanced gpf form 3

| type | |

| pdf size | 14kb |

| pdf page | 3 |

| source/credit | multiple |

![[pdf] gpf form final payment of balance in the Provident Fund Account on death [pdf] gpf form final payment of balance in the Provident Fund Account on death](https://pdfformdownload.co.in/wp-content/uploads/2023/08/gpf-form-2.jpg)

1 thought on “download Advanced Form gpf/cpf”