gpf application form The General Provident Fund (GPF) is a savings scheme introduced by the government for its employees, both in the central and state governments in India. It serves as a long-term savings instrument that offers financial security and stability to government employees during their service and after retirement. The GPF scheme is designed to encourage employees to save a portion of their income regularly, which can be withdrawn upon retirement or other specified events.

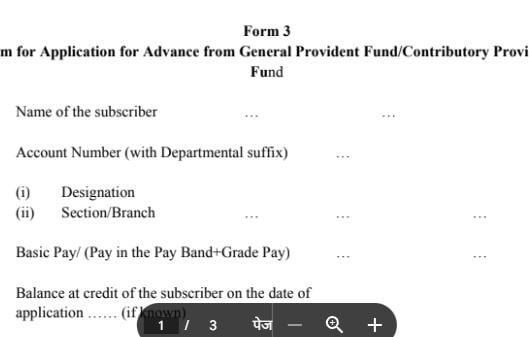

If you need GF Application Form then we have given GF Application Form download link in today’s article, by clicking on which you can easily download GPF Form.

Key Features of the GPF

Voluntary Contribution: Government employees can voluntarily contribute a portion of their salary to the GPF. The contributions are deducted from the employee’s salary every month and are matched by a similar contribution from the employer.

Accrual of Interest: The GPF contributions earn interest at rates determined by the government. The interest rates are typically higher than standard savings accounts, making GPF an attractive savings option.

Long-Term Savings: GPF is designed to promote long-term savings, serving as a financial cushion during retirement or in times of financial need.

Tax Benefits: GPF contributions are eligible for tax deductions under Section 80C of the Income Tax Act. Moreover, the interest earned is also tax-exempt, making it a tax-efficient investment avenue.

Withdrawal Options: While the primary purpose of GPF is retirement savings, partial withdrawals can be made for specific purposes like medical emergencies, higher education, home construction, and more.

Nomination: Employees are required to nominate beneficiaries who will receive the accumulated funds in the event of the employee’s death before retirement. This ensures the financial well-being of the employee’s family.

Portable Account: If a government employee changes jobs or departments within the government, their GPF account is transferable. This ensures the continuity of their savings even if their employment changes.

Compound Interest: The GPF contributions earn compound interest, which means that the interest is calculated not only on the initial principal but also on the accumulated interest from previous periods. This leads to accelerated growth over time.

Financial Security: GPF provides a sense of financial security and stability to employees, especially during their retirement years, by offering a lump sum amount that they can rely on.

Transparency: Employees can monitor their GPF balance and contributions through regular statements provided by the government.

In Conclusion:

The General Provident Fund (GPF) is a crucial financial instrument that caters to the long-term savings and retirement needs of government employees in India. It offers a combination of tax benefits, compound interest, and withdrawal flexibility, making it an attractive avenue for secure financial planning. By understanding the features and benefits of the GPF scheme, government employees can make informed decisions about contributing to their GPF account and securing their financial future

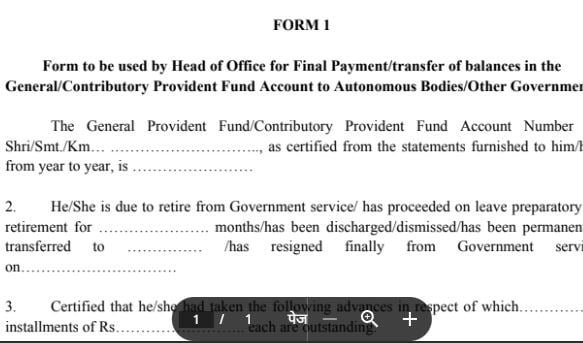

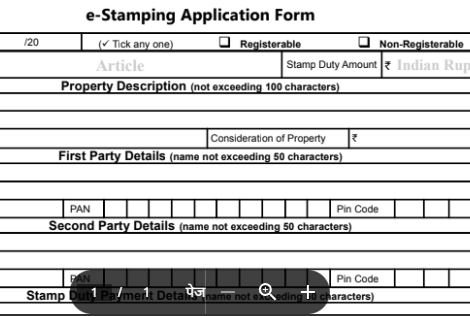

download gpf application form 1 pdf

| type | |

| pdf size | 7kb |

| pdf page | 1 |

| source/credit | multiple |

![[DOWNLOAD] NPCI Form PDF A Comprehensive Guide to Everything You Need to Know [DOWNLOAD] NPCI Form PDF A Comprehensive Guide to Everything You Need to Know](https://pdfformdownload.co.in/wp-content/plugins/contextual-related-posts/default.png)

![[pdf] gpf form final payment of balance in the Provident Fund Account on death [pdf] gpf form final payment of balance in the Provident Fund Account on death](https://pdfformdownload.co.in/wp-content/uploads/2023/08/gpf-form-2.jpg)

![[PDF] पटवारी प्रतिवेदन फार्म डाउनलोड करें | patwari prativedan form PDF download [PDF] पटवारी प्रतिवेदन फार्म डाउनलोड करें | patwari prativedan form PDF download](https://pdfformdownload.co.in/wp-content/uploads/2023/02/patwari-prativedan-form-pdf-download.jpg)

3 thoughts on “download gpf application form 1 pdf”