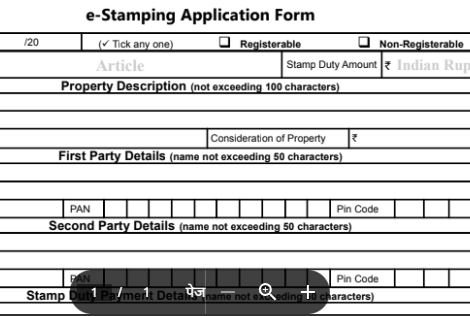

e stamping application form , short for electronic stamping, is a modern and digital method of paying stamp duty for various legal and financial documents. Stamp duty is a tax imposed by governments on certain types of transactions or documents to make them legally valid and enforceable. Historically, physical adhesive stamps were affixed to paper documents to indicate that the necessary tax had been paid. However, e-stamping replaces this traditional approach with an electronic equivalent, streamlining the process and increasing efficiency.

In e-stamping, the payment of stamp duty is done electronically through a dedicated online platform or portal provided by the government or authorized agencies. This platform allows individuals and businesses to calculate, pay, and generate electronic certificates (e-stamp certificates) that serve as proof of payment for stamp duty. These e-stamp certificates contain unique identification details, transaction information, and a digital signature to ensure authenticity and security

In today’s article, e-Stamping Application Form PDF has been provided, if you need it, you can easily download it by clicking on the e-Stamping Application Form PDF download link given below, apart from this, all the information related to this stamp is shared here. tried to do that may be important to you

E-stamping offers several advantages

E-stamping offers several advantages over traditional physical stamping:e

Convenience: E-stamping eliminates the need to physically procure and affix paper stamps, saving time and effort.

Efficiency: The entire process, from calculation to payment and generation of e-stamp certificates, is streamlined and can be completed online.

Accuracy: Automation reduces the chances of errors in calculations and eliminates the possibility of using counterfeit stamps.

Security: E-stamp certificates are equipped with digital signatures and encryption, making them tamper-proof and ensuring their authenticity.

Record Keeping: E-stamping platforms often provide a centralized repository for e-stamp certificates, making record-keeping and retrieval easier.

Reduced Fraud: E-stamping systems incorporate security features that deter fraudulent activities, contributing to the integrity of the stamp duty collection process.

Accessibility: Users can access e-stamping services 24/7 from anywhere, reducing geographical limitations.

E-stamping is commonly used for various documents, such as property agreements, leases, deeds, contracts, and other legal and financial documents that require legal validation. It’s important to note that the availability and regulations regarding e-stamping can vary from one jurisdiction to another, so it’s crucial to understand the local laws and regulations before opting for e-stamping.

In summary, e-stamping is a digital innovation that replaces traditional physical stamping with an electronic process for paying and validating stamp duty on legal and financial documents. It offers convenience, efficiency, accuracy, and security while aligning with the digital transformation of administrative processes

Getting Started with E-Stamping Application: Step-by-Step Guide

e stamping application form filling – E-stamping has simplified the process of paying stamp duty for legal and financial documents. This step-by-step guide will walk you through the process of getting started with an e-stamping application, ensuring a smooth and hassle-free experience.

Step 1: Accessing the E-Stamping Portal

Open a web browser and navigate to the official e-stamping portal provided by your local government or authorized agency.

Step 2: Registration and Login

If you’re a first-time user, you’ll need to register for an account on the e-stamping portal.

Provide your personal information, including name, contact details, and a valid email address.

Create a secure password for your account.

Follow the verification process, which may involve receiving a verification code via email or SMS.

Once verified, log in to your newly created e-stamping account.

Step 3: Selecting the Document Type

Identify the type of document for which you need to pay stamp duty.

Select the appropriate category or type of document from the options available on the portal

Step 4: Filling out Applicant Details

Provide accurate and complete details about the applicant, which may include personal information and contact details.

Verify that the provided information is correct before proceeding

Step 5: Document Details and Description

Enter the relevant details of the document that requires stamping, such as the title, date, parties involved, and any other required information.

Include a brief description of the document’s purpose and content

Step 6: Payment Options and Calculating Stamp Duty

Choose your preferred payment method. Most portals offer various payment options, including credit/debit cards, online banking, and digital wallets.

Use the provided tools on the portal to calculate the stamp duty amount based on the document type and transaction details

Step 7: Uploading Supporting Documents

Some e-stamping applications may require you to upload supporting documents, such as scanned copies of the document to be stamped or identity verification documents.

Make sure the uploaded documents are clear and legible

Step 8: Verification and Preview

Review all the information you’ve entered to ensure accuracy.

Verify that the calculated stamp duty amount matches the expected value

.

Step 9: Making Corrections (if needed)

If you identify any errors or inaccuracies, use the provided options to make corrections.

Double-check all changes to ensure they’re accurate

Step 10: Final Submission

Once you’re confident that all information is accurate, and the payment details are correct, submit the e-stamping application.

If applicable, make the payment for the calculated stamp duty amount using your chosen payment method

Conclusion

E-stamping application has made paying stamp duty for legal and financial documents a convenient and efficient process. By following this step-by-step guide, you can confidently navigate the e-stamping portal, enter accurate information, calculate stamp duty, and make secure payments. Remember that the specific steps and features may vary depending on your jurisdiction and the e-stamping platform you’re using. Always stay vigilant while providing personal and financial information online and keep a record of the generated e-stamp certificate for your records

e stamping application form download

| article | e stamping application form |

| type | |

| pdf size | 111kb |

| pdf page | 1 |

| benificiry | indian |

| source/credit | multiple |

| website | click hare |

![[DOWNLOAD] NPCI Form PDF A Comprehensive Guide to Everything You Need to Know [DOWNLOAD] NPCI Form PDF A Comprehensive Guide to Everything You Need to Know](https://pdfformdownload.co.in/wp-content/plugins/contextual-related-posts/default.png)

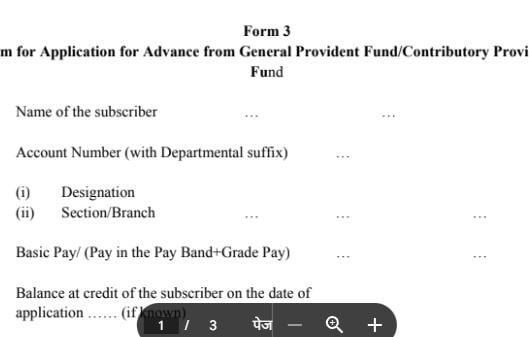

![[pdf] gpf form final payment of balance in the Provident Fund Account on death [pdf] gpf form final payment of balance in the Provident Fund Account on death](https://pdfformdownload.co.in/wp-content/uploads/2023/08/gpf-form-2.jpg)

1 thought on “download e stamping application form pdf”