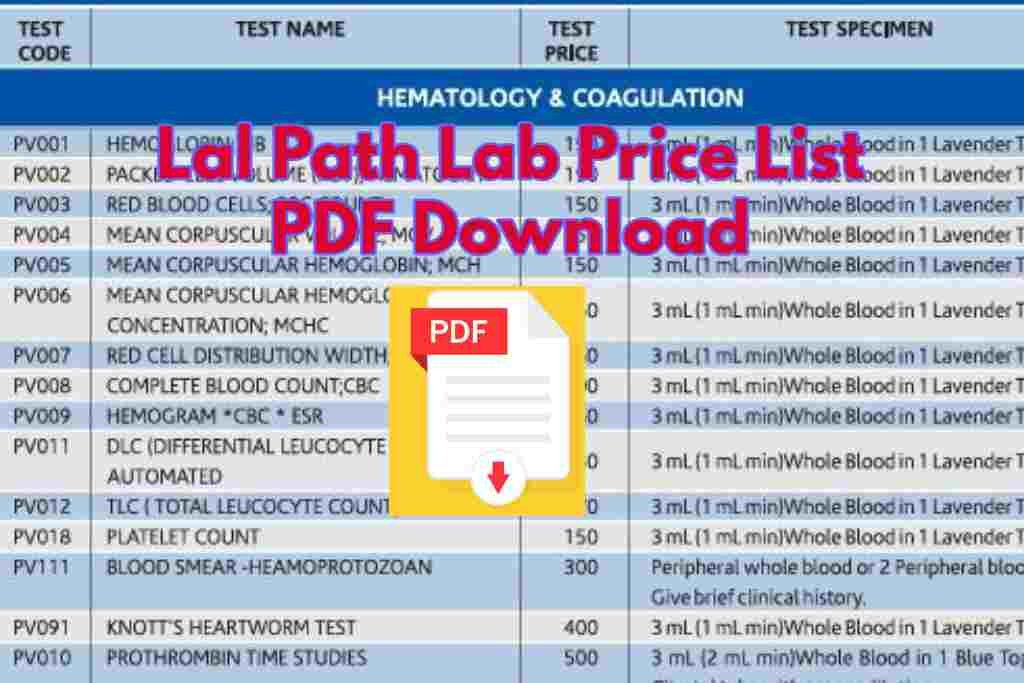

80C Deduction List PDF Download – When it comes to tax savings, the 80C deduction is one of the most popular options available to individuals in India. Under Section 80C of the Income Tax Act, taxpayers can claim deductions for certain investments and expenses, thereby reducing their taxable income. To help taxpayers understand the eligible investments and expenses, the government provides an 80C deduction list in PDF format.

What is the 80C Deduction List?

The 80C deduction list is a comprehensive document that outlines the various investments and expenses that are eligible for tax deductions under Section 80C. It includes a wide range of options, allowing taxpayers to choose the ones that best suit their financial goals and needs.

While the list is not exhaustive, it covers the most common investments and expenses that qualify for deductions. Some of the key items included in the 80C deduction list are:

- Life insurance premium

- Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- 5-year fixed deposit with a bank

- National Savings Certificate (NSC)

- Tuition fees for children’s education

- Principal repayment on home loan

- Equity-linked Saving Scheme (ELSS)

- Sukanya Samriddhi Yojana (SSY)

- Senior Citizen Savings Scheme (SCSS)

- And many more…

It is important to note that the maximum deduction allowed under Section 80C is ₹1.5 lakh. Therefore, taxpayers should carefully consider their investments and expenses to make the most of this deduction.

Why Download the 80C Deduction List PDF?

Downloading the 80C deduction list in PDF format can be beneficial for several reasons:

- Easy reference: The PDF format allows taxpayers to easily access and refer to the list whenever needed. It can be saved on a computer or mobile device, making it convenient for quick reference.

- Offline access: Unlike online resources, the PDF can be accessed offline, making it useful for individuals who may not have a stable internet connection at all times.

- Printable: Taxpayers have the option to print the PDF and keep a physical copy for their records. This can be helpful for those who prefer to have a hard copy for reference.

- Shareable: The PDF can be easily shared with family members, friends, or colleagues who may also benefit from the information. It allows for easy dissemination of knowledge.

Download

How to Obtain the 80C Deduction List PDF?

Obtaining the 80C deduction list in PDF format is a simple process. There are several ways to access it:

- Income Tax Department website: The official website of the Income Tax Department provides a downloadable PDF version of the 80C deduction list. Taxpayers can visit the website and navigate to the relevant section to find the list.

- Financial institutions: Many banks and financial institutions also provide the 80C deduction list on their websites. Individuals who have accounts or investments with these institutions can check their respective websites for the PDF.

- Professional tax advisors: Tax advisors and consultants often have the 80C deduction list as part of their resources. They can provide a copy of the PDF to their clients for reference.

It is important to ensure that the downloaded PDF is from a reliable source, such as the Income Tax Department website or a trusted financial institution. This will ensure that the information is accurate and up to date.

Conclusion

The 80C deduction list in PDF format is a valuable resource for taxpayers looking to save on their taxes. By understanding the eligible investments and expenses, individuals can make informed decisions and maximize their tax savings. Whether it’s life insurance premiums, EPF contributions, or tuition fees, the 80C deduction list provides a wide range of options to choose from. So, download the list, explore the possibilities, and make the most of the tax benefits available under Section 80C.

![[PDF]श्री लक्ष्मी जी की आरती download करे | laxmi aarti pdf in hindi 2023 [PDF]श्री लक्ष्मी जी की आरती download करे | laxmi aarti pdf in hindi 2023](https://pdfformdownload.co.in/wp-content/uploads/2023/10/laxmi-aarti-pdf-D.jpg)